Pricing Tender Contracts: A Real Option Pricing Approach

The practice of granting twelve or more months of price guarantee in tenders results in a significant value transfer from carriers to shippers. The size of the potential margin given-up by the carriers has increased from under 10% in the pre-Covid era to ~15% recently. Carriers can use basic option pricing approaches to recapture some of that value without a large risk of alienating the shippers.

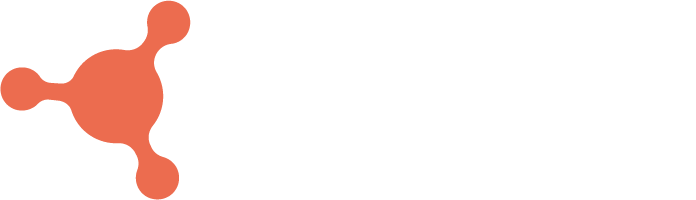

A shipping tender contract is a real AND “imperfect” option

A tender contract can be treated as a value-added service provided by the carrier to the shipper. Shippers will always require price visibility for 12-18 months to be able to predict their costs.

A contract has features of an “imperfect” real option: there is a shipment price agreed months ahead, however, shipment volumes are not strictly adhered to. The “imperfection” stems from the fact that carriers do see some volumes even if the agreed upon tender price at the time of shipment is above the spot price. This could be due to the perceived or real quality of the carrier, or the need to maintain the relationship.

An (real) option is an economically valuable right to make or abandon a choice that is available to the management. In this case, shippers have the choice to ship based on the tender contract or with someone else in the spot market (or re-tender if the tender price turns out to be too high).

A real option has an economic value. This value is passed to the shipper by the carrier.

Often the contract price is below the spot price. If the contract has an option value, then why is the carrier “giving it away” for free? The answer is that in exchange for an “imperfect” option, the carrier receives some (imperfect) guarantee of capacity utilization.

In markets that are expected to recover the contract price is above the spot price. This does not mean that the carrier is fully compensated for granting the option: the shipper can still skip the volumes and the spot prices can still be higher. Even in this case, carrier gives-up value to the shipper.

PRICING THE REAL OPTION

Option pricing has been a regular practice in the finance industry since the 1980s. Although a tender contract has special features beyond a real option, using option pricing can still help understand how much value is passed to the shipper and what is the development of that value over time.

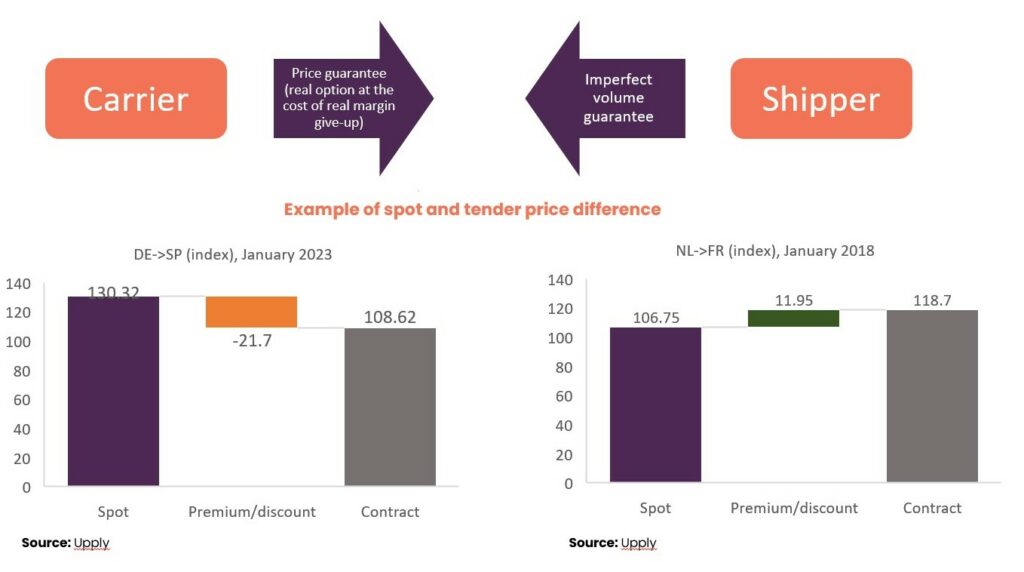

Contract and spot prices are only two of five important components of the option value. The others are:

- Volatility: the higher the historical volatility (variability) of the spot price, the greater the chance that the spot price may be much higher than the contract price during the life of the tender. Of course, it can be lower too, but since the shipper does not grant firm guarantee of the volumes, high volatility increases the value of the option for the shipper.

- Time-to-expire: longer contracts also mean a greater chance of the spot price ending up well above the contract price.

- Interest rates: since a tender contract deals with financial obligations that happen in the future, interest rates relate the future value of those obligations to today’s value of money.

In this example (based on route price indexes), the additional value passed by the carrier to the shipper is 17.6% of the spot price, in other words, the carrier pays 17.6% of today’s margin in order to get volume in the future.

***

This value does not depend on the spot price in the future, but only on the current spot and contract rates and the volatility of the spot price. On the average, by bidding the contract price of 128.9 for this route, the carrier will make 17.6% less money compared to doing business in the spot market at the time of tender’s validity.

HOW MUCH MARGIN DOES A CARRIER GIVE-UP BY QUOTING 12M CONTRACTS IN EUROPE ?

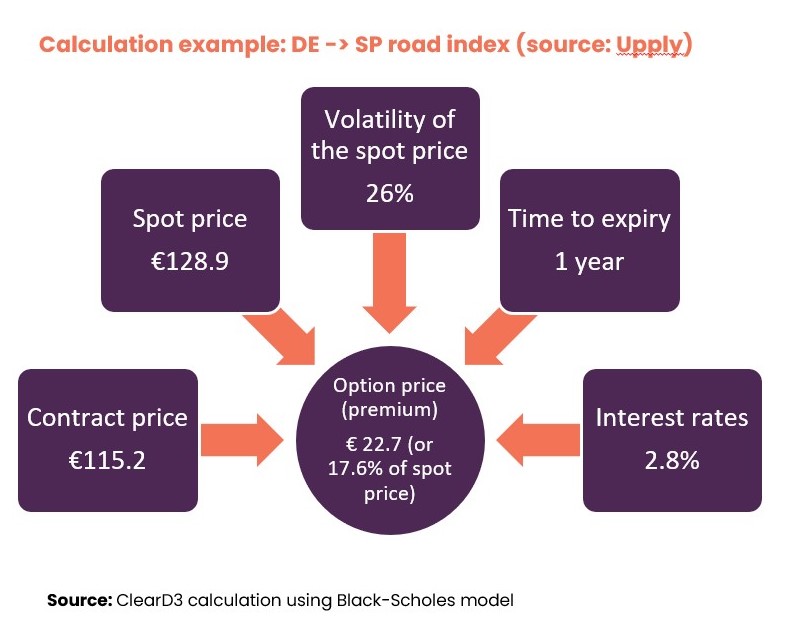

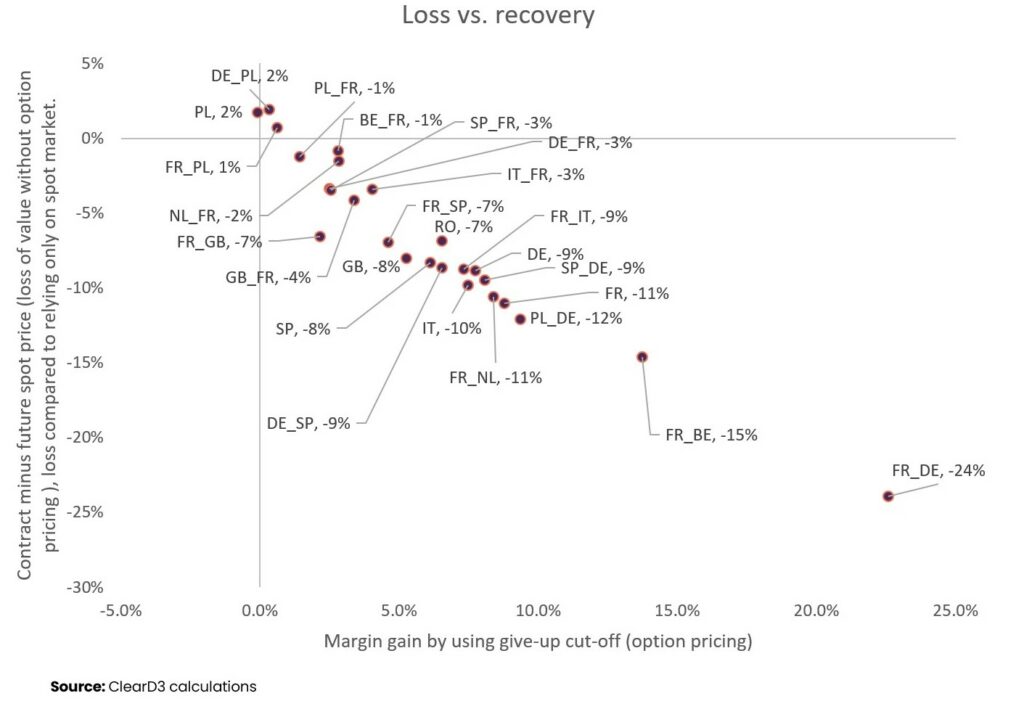

There is a wide range of average option price (margin give-up) per route. This calculation based on data from March 2023 shows a range of 9% to 27%.

Given such a wide range of pricing differences, it is fair to assume that by establishing a maximum margin give-up, a carrier can limit margin drift while carefully managing the risk of losing tenders.

Since the carrier will always have to quote all routes to remain an attractive partner for shippers, the key is to set a contract price limit in terms of margin give-up (option value). This way, the routes that are bound to lose a lot of value will not be priced competitively and will be ignored by the shipper.

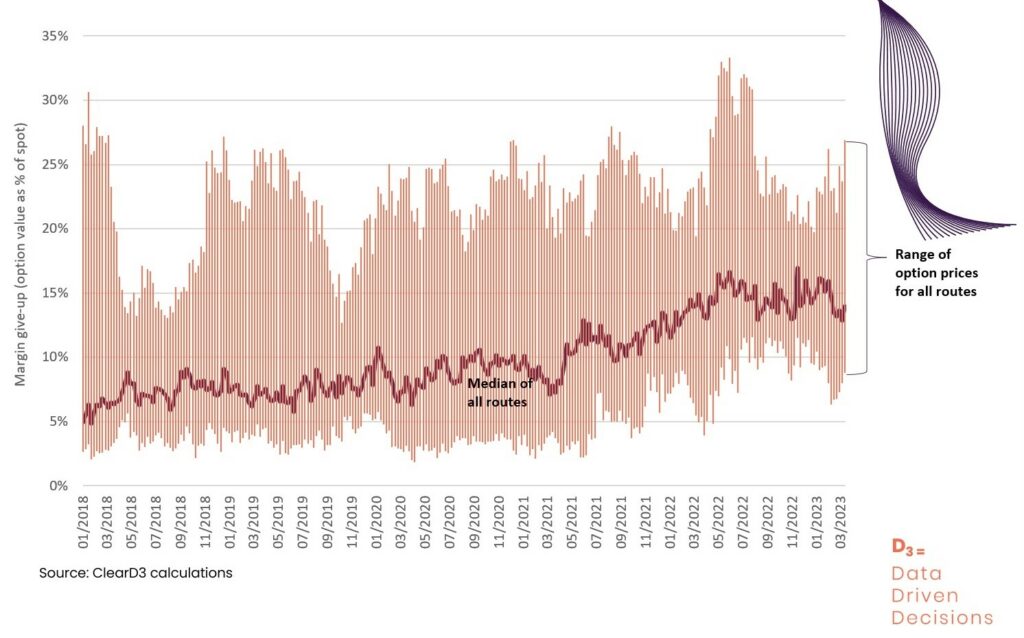

The question becomes whether there is always a sufficiently wide range (e.g. 9% to 27%) of margin give-up cost or is this a post-Covid issue?

ARE THERE SUFFICIENT ROUTES WITH ATTRACTIVELY PRICED CONTRACT VALUES TO KEEP CAPACITY?

As it turns out, for the most part the median margin give-up (dark line on the graph) across all routes has been between 5% and 10% until 2021. Since then, the median has settled at around 15% due to the higher volatility of prices, which increases the risk for the carrier.

On the other hand, the range of routes with high and low option pricing has always been high (light vertical lines on the graph).

This means it is possible for the carrier to discriminate between routes that are potential loss-makers and profitable routes in the tender market.

HOW DOES THE TENDER PRICE SETTING BASED ON OPTION VALUE WORK?

A typical tender is priced based on the current spot prices, but the volatility of the spot price is the most important input. The carrier sets a maximum margin give-up for tender contracts. The option value for each of the hundreds of routes is calculated and the tender price of the route is set based on the option value.

This enables the carrier to cut the risk of loss-making routes in the future without any knowledge of future prices.

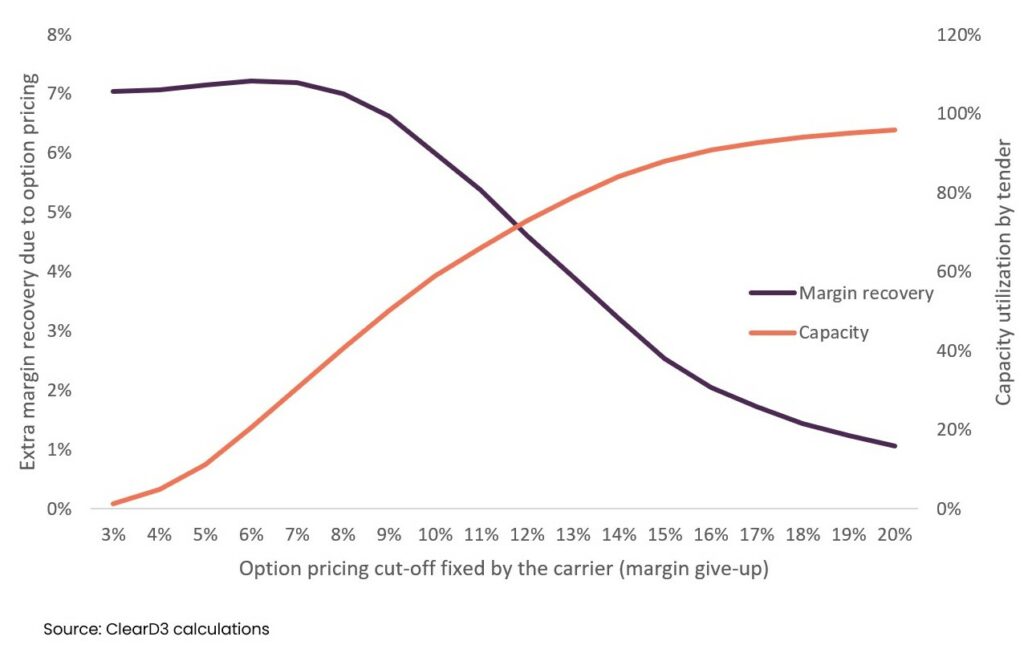

At the same time, this cuts the “imperfect certainty” of the capacity utilization. For example, a very low margin give-up limit of 3% provides an overall margin improvement of 7% for the carrier. But it also cuts the capacity utilization from tenders nearly to 0. As the give-up limit is increased, the margin improvement shrinks down to 2 % for a 16% give-up. This suggests that removing only the extreme loss makers (e.g. FR->BE, FR->DE) adds 2% to the carrier’s margin with very limited impact on capacity.

Ultimately, the carrier must strike a balance between the margin and tendered capacity.

HOW MUCH MARGIN DOES A CARRIER GIVE-UP IN EUROPE?

The greater the imbalance on the route, the greater the impact of option pricing. On the more balanced routes, option pricing makes a small difference. Tender routes that are inherently loss-making are highlighted by option pricing very clearly. Increasing tender prices on only these routes will improve the carrier margin by 1 percentage point (of revenues, i.e. 10-20% increase of cash margins for many carriers), without any risk on capacity utilization.

CONCLUSIONS AND FINAL REMARKS

- Option pricing can help carriers set tender prices by route with available information and even without the need to attempt to forecast future demand (though a reliable forecast of future demand may further enhance the pricing).

- At a minimum, option pricing helps identify potential extreme loss makers and limit the risk of value loss with limited risk of loss of capacity utilization in tender contracts.

- Based on historical data, a margin recovery of 2% without a risk of lower capacity utilization using option pricing is attainable.

- Eventually, carriers may retain up to 7 percentage point of revenues by focusing only on the spot markets. This means doubling margins for a typical transport company, however, at the expense of much higher risk of low capacity utilization and uncertain impact on the relationships with the shippers.

- The ultimate implementation will depend on finding the correct balance between the capacity utilization risk and margin (loss). Lower capacity utilization may increase unit costs and cut the margins on spot contracts as well as tender contracts with good economics. It is therefore important to combine the option pricing with a complete pricing engine that considers the cost and capacity dynamics.

Complementary forecasts for the end markets of freight transportation & logistics companies in Europe

to add value in making pricing and capacity decisions at your company.